Co-branding: Reebok and CrossFit

January 22, 2014Technology Phenomenon

January 27, 2014Acing Your Children’s College Tuition

The 529 Plan: College Savings 101

Today, there are many ways to manage both single and multigenerational opportunities.

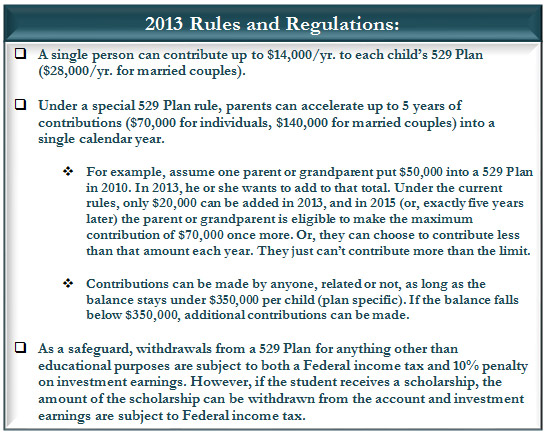

The 529 plan is one of them. It is a tax-advantage higher education savings plan generally operated by a state or an educational institution. A popular option among parents who like to think ahead, it is designed to aide families in saving for the looming cost of college.

The 529 Plan not only features tax-free growth and withdrawals, but it offers multigenerational planning as well. By maximizing contributions to the plan without subjecting oneself to additional taxes or penalties, one can capitalize on benefits offered under the 529 Plan.

1 2