Succession Planning

March 20, 2014Sales and Marketing Plan

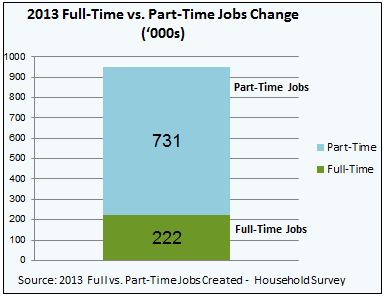

March 21, 2014 The largest generation in American history soars above the “Baby Boomers” by seven percent. While Millennials are the most educated group, this generation has the highest unemployment rate. Their unemployment rate is currently reaching 17%, higher than the national rate which lingers around seven percent. According to Pew Research, young people who graduate from college in a bad economy typically suffer long-term consequences, affecting their careers and earnings for as long as 15 years.7 In 2013, the number of jobs available grew to about 953,000. Out of this figure, about 77% of the jobs created were part-time.2 Undoubtedly, there is a disparity between the amount of full-time jobs available and the number of members in this cohort.

The largest generation in American history soars above the “Baby Boomers” by seven percent. While Millennials are the most educated group, this generation has the highest unemployment rate. Their unemployment rate is currently reaching 17%, higher than the national rate which lingers around seven percent. According to Pew Research, young people who graduate from college in a bad economy typically suffer long-term consequences, affecting their careers and earnings for as long as 15 years.7 In 2013, the number of jobs available grew to about 953,000. Out of this figure, about 77% of the jobs created were part-time.2 Undoubtedly, there is a disparity between the amount of full-time jobs available and the number of members in this cohort.

Economic Environment

Since the first Millennial entered the workforce in 2002, economic conditions were unstable, political and ever-changing. The generation that was exposed to the job market soon after the attacks of September 11th and in the midst of the Great Recession appears to have a bigger financial burden than previous generations. In response, the Millennials have come in to the habit of conservatively saving any money that they earn, being referred to as “children of the recession”10, which is impacting their spending purchases.

As a result, instead of purchasing homes, Millennials are renting or moving back home with their parents. Instead of buying cars, Millennials are choosing greener methods via public transportation or biking. Instead of starting families, the majority of Millennials are single and saving at a whopping 75%.7

As if this isn’t enough, Gen-Y is beginning to confront additional headwinds, and those headwinds are supporting the generation above them. Baby Boomers must rely on their younger counterparts when it comes to their post-retirement living.

According to the Bureau of Census, the amount of people of retirement age will grow from 12.8% of the population today to around 15% by 2020, and about 20% by 2030. More research done by the Bureau suggests that the amount of workers available to support each retiree will fall from 5.2 today to 3.7 by 2020 and to a mere 3.0 by 2030.8 With a decrease in workers and an increase in retirees, pressures are building for the American economy. The shortage of workers directly impacts our economy’s productive power8, which includes being able to provide for the medical and other economic needs of the retiring Baby Boomers.