Interview: Concierge Services

May 20, 2014Flexible Spending Accounts

August 27, 2014What will happen to the plan if I leave my employer or my health plan changes?

HSAs are portable; the employee retains ownership of the account without incurring taxes. When changing jobs, the employee retains ownership of the account without incurring taxes, even if the new employer offers a health plan that does not qualify as high deductible.

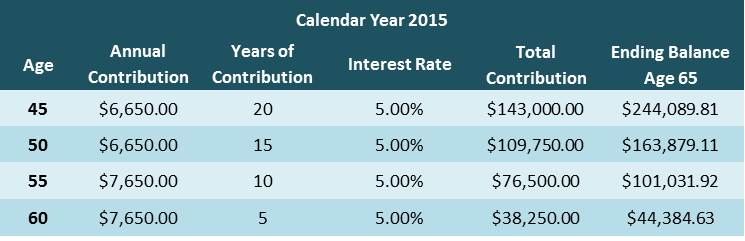

Below is an example of how an annual HSA contribution can affect savings for retirement:

Summary

HSAs clearly offer compelling tax benefits, providing an excellent complement to other retirement savings vehicles. They may also provide an incentive to make careful health care spending decisions, since it is advantageous to keep funds in the plan as long as possible.

SOURCES:

- HSA Strategy: Create a ‘Medical IRA’, Financial Planning. June 5, 2014

- Journal of Financial Service Professionals. January 2012

- Using an HSA for Retirement Savings

Contributors: Paula Pienkowska is the Director of the Wealth Advisory Group at Riverview Capital Advisers. Alan Arcadipane is a Business Analyst of the Business Advisory Group at Riverview Capital Advisers. Peter Gnall is a Private Wealth Adviser of the Wealth Management Group at Riverview Capital Advisers. Melysa Latham is a member of the Business Advisory Group at Riverview Capital Advisers.