Interview: Concierge Services

May 20, 2014Flexible Spending Accounts

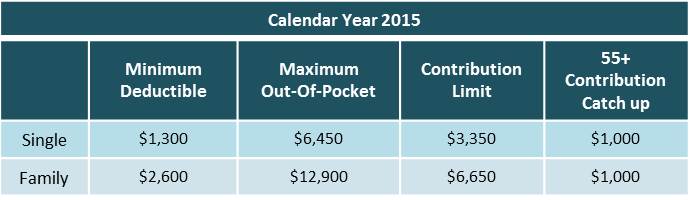

August 27, 2014Those age 55 and older may contribute an additional $1,000 each year. All of the contributions are 100% tax-deductible.

What are the benefits of HSAs?

Although the HSA was designed for health care expenses, it has become an excellent, often overlooked, general retirement funding tool.

The HSA can be used to pay for some or all qualified medical expenses each year. Alternatively, if funds are not immediately needed, they can continue to grow tax free for future qualified medical expenses. Some of the qualified care costs include, but are not limited to: acupuncture, blood tests, braces, dentures, hospital bills, pediatrician, etc.

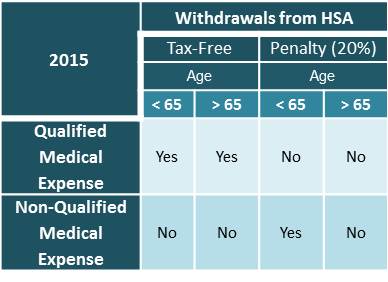

Funds withdrawn for expenses other than medical are subject to income tax, and a 20% penalty (if withdrawn before age 65).

What happens to the HSA after retirement?

After age 65, owners of HSAs who become eligible for Medicare can use HSA funds for any purpose, medical or not. Funds used for qualified medical expenses will not be subject to income tax; however, funds withdrawn for nonmedical purposes will be subject to income tax. This means that after age 65, an HSA essentially transforms into an IRA.

Employers may choose whether or not to offer HSAs to their employees, and may decide to help fund the accounts either partially or fully. Similarly to an IRA, an HSA can be opened by an individual and managed using mutual funds.