Health Savings Accounts

August 27, 2014Asset Protection Planning

February 18, 2015What can FSAs pay for?

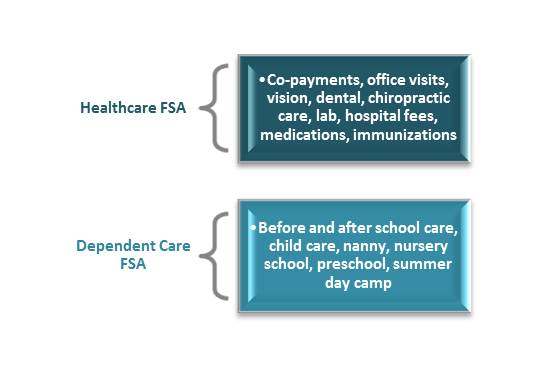

As previously mentioned, you can utilize different types of FSAs to pay for qualified medical expenses that your insurance doesn’t cover, or day-to-day expenses of caring for a dependent. See the chart to the left for a breakdown of qualified expenses for each account.

As previously mentioned, you can utilize different types of FSAs to pay for qualified medical expenses that your insurance doesn’t cover, or day-to-day expenses of caring for a dependent. See the chart to the left for a breakdown of qualified expenses for each account.

Many employers require a written statement from your health care provider to guarantee compliance.

How much can I contribute?

The Healthcare FSA and Dependent Care FSA are independent of each other.

The amount contributed is a commitment between you and your employer and cannot be changed once established during the enrollment period. Healthcare FSA limits are per employee and make no consideration for other family members. Dependent Care FSA limits do allow for a family limit. See the chart to the right for 2014 contribution limits to each plan.

How can I withdraw?

Healthcare FSAs are pre-funded, meaning you can use your committed balance from day one.

For example: A client establishes a Healthcare FSA on January 1st with a committed balance of $2,500. The balance in the plan on January 15th is $250. Suddenly, on February 1st the client incurs a large qualified medical expense of $2,000. With a Healthcare FSA, the client is able to withdraw $2,000 immediately.

On the contrary, Dependent Care FSAs are not pre-funded: the amount of withdrawals must be within the account balance.

For example: A client establishes a Dependent Care FSA on January 1st, the balance in the plan on March 15th is $1,000. On April 1st, the employee would like to use the funds to pay for his son’s preschool. The employee is only allowed to withdraw the accumulated balance of $1,000.

What happens to the balance at yearend?

Employers typically provide two options to their employees on their annual Healthcare FSA contribution. One option is a grace period, in which an employer typically allows up to 2 ½ months following the year-end to use up their balance. The second option is a carryover of the funds to the following year. However, only $500 of the unused balance can be carried over into the employee’s Healthcare FSA for the next calendar year.2 Healthcare FSA cannot have both a carryover and a grace period; it can have one or the other or neither. See example below for a better understanding.

Healthcare FSA Example

A client is an employee of Company X that offers a Healthcare FSA. The client contributed monthly up to his $2,500 limit and at year-end uses only $1,700 of his balance. If Company X offers a grace period, the client would have from January 1st until March 15th to use up the remaining $800. If Company X offers a carryover, the client would only be allowed to carryover a maximum of $500 into his next period, losing the remaining $300. If the company does not allow either option, the balance is forfeited.