Health Savings Accounts

August 27, 2014Asset Protection Planning

February 18, 2015Saving, Flexibly.

Introduction

Flexible Spending Accounts (FSA)s were introduced in the late 1970s as a response to the growing concern of rising cost of health care. *FSAs offer employees a tax-favored program to help pay for unreimbursed qualified medical expenses (Healthcare FSA) and dependent care costs (Dependent Care FSA) for qualifying persons.

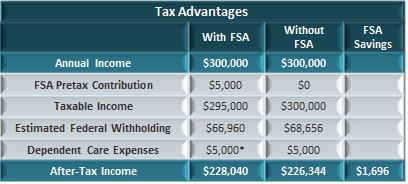

FSA is an employer established plan where both an employee and employer are eligible to contribute. Typically, the FSA is employee-funded through salary deferral and all contributions into the plan are made on a pre-tax basis. This ability to effectively reduce taxable income can result in meaningful increases to an employee’s take home pay.1

While Dependent Care FSA’s are most often utilized with children under the age of 13 years old, it can also be used for children of any age who are physically or mentally incapable of self-care, as well as adult day care for senior citizens who live with the employee. The person(s) on whom the funds are used must be filed as dependent(s) on the employee’s tax return. The funds cannot be used for long-term care for parents who live far away (i.e. nursing homes).

When can I enroll?

The enrollment period is established by your employer; however it is typically towards the end of the calendar year before the current plan period ends.

What is the definition of a qualifying person?

A qualifying person is:

- You and your spouse.

- All dependents you claim on your tax return.

- Any person you could have claimed as a dependent on your return except that:

- The person filed a joint return, or

- Had gross income of $3,900 or more.

- Your child under age 27 at the end of your tax year.

More information, see Publication 503.

*Health plans must be FSA approved. Depending on the size of the company, setup, administration and annual costs apply.