Technology Phenomenon

January 27, 2014Case Study on 401k and ERISA Regulations

January 27, 2014Estate Planning, Explained.

In planning for the future financial state of your family, it is imperative to think about how your wealth will be handled after your death. Estate planning is a powerful tool that allows you to plan and decide what happens to your assets when you’re gone, impacting multiple generations. Without it, major financial and personal decisions regarding your wealth will be left up to the court of law, hospitals or relatives, and may not be in line with the wishes of you and your family.

In planning for the future financial state of your family, it is imperative to think about how your wealth will be handled after your death. Estate planning is a powerful tool that allows you to plan and decide what happens to your assets when you’re gone, impacting multiple generations. Without it, major financial and personal decisions regarding your wealth will be left up to the court of law, hospitals or relatives, and may not be in line with the wishes of you and your family.

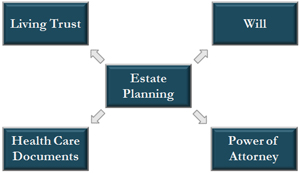

An estate plan consists of a Will, living trust, durable power of attorney, and a health care proxy.

Just about everyone needs a Will. Although your living trust will direct the disposition of your assets, the Will allows you to appoint guardians for minor children. In what’s known as a “pour-over will” you can require that any assets not named specifically in the living trust be transferred to the trust upon death. Your Will also appoints an executor who will need to file an estate tax return.

In a living trust, you name those who will inherit your assets (and when, in the case of minor children) and appoint a trustee to oversee your affairs. A properly designed trust will minimize the impact of estate taxes and protect your beneficiaries’ assets from creditors and ex-spouses.

A living trust also helps protect your family’s confidentiality. Money and property flow through the trust rather than through probate court, which would create a public record of your assets, liabilities and beneficiaries. You, as the grantor of your living trust, have full access and can amend the living trust as you please during your lifetime. Your trustee must live up to the title – someone you trust completely! This person will manage and distribute your assets after your death, so choose your trustee carefully.

Assets not named in your living trust can be distributed through an Assignment of Assets. This document works in conjunction with your living trust and Will to ensure a smooth transfer of assets after your death. Here you can spell out your desire that any assets not specifically named in the trust get transferred there rather than go through probate court. This is useful for both the big items, such as real estate acquired after the trust was set up, and smaller things such as jewelry and household property.